The UAE attracts entrepreneurs from around the world for business setup thanks to its favorable taxation, political and economic stability, and streamlined company formation procedures. Foreigners do not need UAE citizenship or a residence visa to register a company — UAE law allows the establishment of businesses with 100% foreign ownership in most sectors of the economy.

The UAE remains one of the most attractive jurisdictions for business expansion due to a range of strategic advantages. However, despite its clear appeal, entrepreneurs face several challenges that require careful planning and a structured approach.

In this article, you will find a step-by-step guide to business set up in the UAE, learn about the main jurisdiction options (mainland, free zones, offshore), business requirements, expected costs, and the key benefits of operating in the Emirates. At the end, we provide a list of verified sources — official authorities and reputable consulting firms — confirming the information presented.

Advantages and key features of the UAE business setup

The UAE is renowned for its favorable business climate. Below are the main advantages that make the Emirates attractive for small, medium, and large businesses:

- Low Taxes. The UAE imposes no personal income tax, capital gains tax, or dividend tax. Since June 2023, a federal corporate tax of just 9% applies to company profits exceeding AED 375,000 (around USD 100,000), one of the lowest rates globally. Profits below this threshold are taxed at 0%, and companies registered in free zones that meet specific criteria can continue benefiting from a 0% rate on qualifying income. VAT is set at 5% on local goods and services, which is relatively low. Many free zones also offer additional tax incentives, such as extended corporate tax holidays, to attract investors.

- 100% Foreign Ownership. Foreign investors can fully own a company in the UAE without the need for a local partner, both in free zones and, following recent reforms, on the mainland for most business sectors. Previously, a 51% local ownership requirement applied to mainland companies, but updates to the Commercial Companies Law (2020–2022) have largely removed these restrictions.

- Ease and Speed of Registration. Company registration procedures are highly streamlined. Many processes can be completed online, and some business types can be registered within minutes via electronic platforms such as the Bashr portal. Business licenses are issued through “one-stop shops” in the economic departments of each emirate or via free zone authorities. Typical registration times range from a few days to a couple of weeks, depending on the chosen jurisdiction and completeness of documentation.

- No Currency Controls. The UAE imposes no strict restrictions on currency operations: capital can be freely brought in and repatriated, and profits can be transferred abroad without obstacles. This facilitates international payments and fund transfers.

- Developed Infrastructure and Business Environment. The Emirates offer modern office centers, world-class logistics hubs, and efficient banking services. Highly developed transport, financial, and IT infrastructure simplifies business setup and operations. The UAE ranks among the top countries in the region for ease of doing business and global competitiveness. Skilled professionals from around the world are readily available due to the country’s attractiveness for expatriates. Free zones also offer flexible options such as virtual offices or “flexi-desks,” with government services (registration, visa issuance, utilities) streamlined through free zone authorities, making it easier to operate export-oriented companies, IT startups, e-commerce, and consulting businesses.

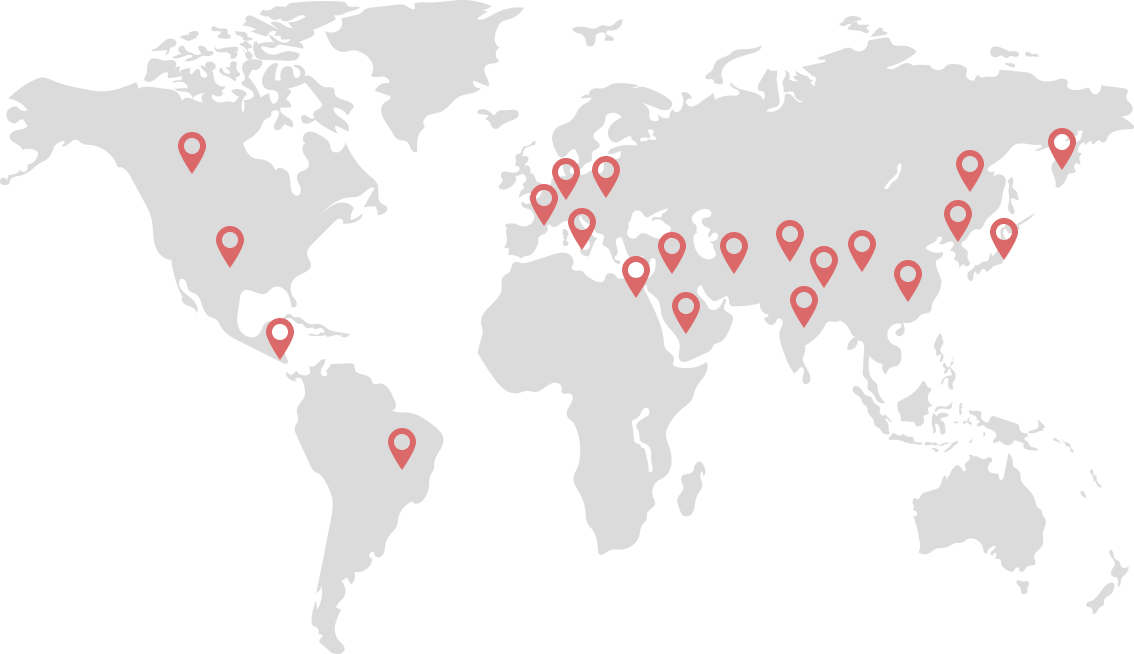

- Strategic Location and Market Access. The UAE is at the crossroads of trade routes connecting Asia, Europe, and Africa, providing direct access to the Middle East and South Asian markets. The country is a member of the World Trade Organization and has signed free trade agreements with multiple countries and regions, facilitating international business operations.

- Political and Economic Stability. The UAE maintains a stable political environment and a well-structured legal system, reducing uncertainty and supporting safe business operations.

- High Standard of Living and Strong Consumer Demand. High incomes and steady demand for quality products make the UAE market attractive for businesses, especially in the mid- to high-end segments.

- Government Support. The UAE government actively promotes foreign investment through favorable policies, simplified registration, licensing, and product certification procedures.

- Cultural Openness and Multinational Environment. The UAE is a multicultural society open to collaboration. English is widely used in business, and the presence of numerous international companies creates a supportive environment for adaptation and growth.

Potential challenges and risks when setting up a company in the UAE

- High initial costs. Despite low taxes, the cost of starting a business in the UAE can be significant. Mandatory expenses include registration fees, license costs, office rental, and fees for local agents or consultants. A full “turnkey” setup can start at several thousand dollars, with an average around $10,000. Annual expenses for license renewal and ongoing operations (e.g., accounting, office rental, and administrative services) may reach $10,000–$15,000 per year, which makes the entry threshold for small businesses fairly substantial.

- Strict banking and compliance requirements. Opening a corporate bank account is one of the most time-consuming tasks for new companies. UAE banks conduct thorough due diligence, requesting extensive documentation. Account approval can be delayed or denied, requiring applications to multiple banks, sometimes taking months. Businesses must maintain full transparency, proving the legality of funds, business plans, and contracts. Regulatory requirements—including economic substance rules for certain entities—demand real business presence and proper record-keeping.

- Jurisdictional limitations. Companies registered in a specific emirate or free zone may face territorial restrictions. For instance, free zone companies generally cannot trade directly on the UAE mainland without a local distributor. Clients from other emirates often prefer working with businesses registered locally. Covering the entire UAE market may therefore require multiple licenses across different emirates or a mainland company structure.

- Sector-specific restrictions. Certain activities require additional approvals or a UAE national partner. Industries such as defense, media, healthcare, and strategic sectors (oil & gas, transportation) have special licensing rules and limits on foreign ownership.

- High competition. The UAE market is highly saturated with international brands across almost all sectors. New businesses must develop a strong marketing strategy and identify clear unique selling points to compete effectively.

- Need for product and marketing adaptation. Cultural preferences and consumer behavior require businesses to carefully tailor their products and marketing strategies to local tastes.

- Certification and licensing requirements. The UAE enforces strict certification and registration standards, particularly for food, pharmaceuticals, cosmetics, and apparel. Companies must account for the time and costs associated with these procedures when planning operations.

- Intellectual property protection limitations. While progress has been made in protecting intellectual property, risks related to counterfeiting and insufficient copyright enforcement remain relevant.

After weighing the advantages and risks, you can proceed to choose the optimal form of market presence in the UAE.

Choice of jurisdiction: Mainland, Free Zone, or Offshore

The first step is to determine the jurisdiction for company registration. In the UAE, there are three main options for doing business, each differing in legal status and operating conditions:

- Mainland (onshore) – registration of a company in one of the Emirates (Dubai, Abu Dhabi, etc.) through the local Department of Economic Development (DED). An onshore company is allowed to operate throughout the UAE (as well as internationally) and work with partners anywhere in the country. Previously, a local partner with a 51% share was required, but now foreign investors can own a mainland company fully (except in certain regulated sectors). A mainland company must have a physical office in the UAE and obtain the corresponding business license from the Emirate. It is also subject to all federal laws (for example, on taxation and labor) and the regulations of the Emirate of registration.

This option is ideal for entrepreneurs targeting the local UAE market, retail trade, construction, government tenders, and other projects within the country. - Free Zone – registration within one of the UAE’s special economic zones offering preferential business conditions. There are over 40 free zones across the UAE (more than 50 in Dubai alone), each managed by its own administrative Free Zone Authority and governed by its own rules. A free zone company can be 100% foreign-owned and is often exempt from corporate tax for a certain period (or under specific operational conditions within the zone). Business activities within the zone are unrestricted; however, to operate in the mainland, a company must either establish a branch/subsidiary or partner with a local distributor and pay customs duties when supplying goods to the UAE market.

Office requirements are minimal — often a small flexi-desk or shared workspace is sufficient — making this option convenient for startups or businesses that do not require a constant physical presence in the UAE. - Offshore – registration of a company in one of the UAE’s offshore jurisdictions, such as JAFZA Offshore (Dubai) or RAK ICC (Ras Al Khaimah), designed for conducting business outside the UAE. Offshore companies do not receive a trade license for operations within the UAE and cannot conduct business domestically. Instead, they are typically used for international trading, asset ownership, or holding structures.

Key advantages include simple registration, no taxation in the UAE, and high confidentiality. However, offshore entities are not eligible for UAE residence visas and must operate through a certified registered agent. Offshore companies are often chosen by large international groups to optimize corporate structures or protect assets.

For clarity, let’s compare the key characteristics of Mainland vs Free Zone vs Offshore in the table below:

| Criterion | Mainland | Free Zone | Offshore |

| Scope of Activity | Throughout the UAE and abroad (no territorial restrictions within the country). | Within its own free zone and on the international market. Direct operations in the UAE mainland are prohibited without a local intermediary. | Only outside the UAE (no right to conduct commercial activities within the country). |

| Foreign Ownership | Up to 100% (in most sectors). Previously, a local partner with 51% was required, but this has now been removed for most industries. | 100% foreign ownership | 100% foreign ownership (through a registered agent). |

| License | DED license of the specific Emirate, granting local company status. | License from the Free Zone Authority, valid within the zone and for international operations. | ompany registration (Certificate of Incorporation), without a trade license. |

| Taxes | Corporate tax of 9% applies (for profits above the threshold). VAT 5% on transactions within the UAE. No exemptions except for small businesses (0% tax for turnover < 3 million AED until 2026). | Most free zones offer tax holidays or 0% corporate tax (if qualifying income conditions are met). VAT is not applied on exports; services/goods within the UAE are taxed at 5%. | No taxes in the UAE (income is considered earned outside the UAE). VAT does not apply since there are no operations within the UAE. |

| Office Requirement | A physical office/address in the UAE is mandatory (minimum – a fully equipped workspace). Office size depends on the type of activity and may be regulated. | Physical presence in the zone is required; usually, a small office, flexi-desk, or warehouse is sufficient depending on the business. Rent is often arranged by the Free Zone Authority. | No office rental is required. The legal address is provided by the registered agent. |

| Resident Visa | Yes, resident visas can be obtained for founders and employees. The number of visas depends on the office size (number of workstations). | Yes, the Free Zone Authority issues resident visas within the quota (usually 2–6 visas per company with a basic package; more visas available for additional fees or larger office space). | No, offshore companies do not grant the right to a UAE resident visa as they do not operate within the UAE. |

| Regulatory Requirements | Full compliance with UAE laws is required: local accounting, possible audit (depending on company size), annual license renewal via DED, and compliance with Emiratization rules (local workforce quotas for large companies). | Compliance with the specific Free Zone’s regulations (annual audit required in some zones, e.g., DMCC; annual license renewal). Federal requirements such as economic substance and anti-money laundering rules also apply. | Minimal requirements: annual registration renewal through the agent, maintaining records for internal purposes, and compliance with international transparency rules (e.g., beneficial ownership registry). |

| Suitable Business Type | Local business, UAE projects, companies intending to fully operate in the domestic market or participate in government tenders. | International business, export/re-export, online services, startups that do not require a physical presence in the UAE market. | Holding structures, asset ownership, international trade without plans to operate in the UAE market. Designed for corporate structuring and asset protection. |

Note: The choice of jurisdiction is determined by the company’s strategy. For small businesses that do not need to operate “on the ground” in the UAE, it is often more advantageous to start in a Free Zone due to lower costs and simplicity. Large companies or projects targeting the government sector typically choose Mainland registration for maximum operational freedom.

Choosing the legal structure of a company

In addition to selecting the jurisdiction, it is essential to determine the legal structure of the company when registering in the UAE. UAE law provides several options, with the most popular being:

- LLC (Limited Liability Company) – Similar to a limited liability company. It can be established by one or more founders, with capital divided into shares. An LLC can be Mainland (subject to the laws of the respective Emirate and the UAE Federal Companies Law) or registered in a Free Zone (commonly called FZ LLC). LLC members are not personally liable for the company’s obligations; the risk is limited to the capital contribution. This is the most common form for commercial activity.

- If there are multiple founders, a Memorandum of Association (MOA) is signed.

- Mainland LLCs may require a Local Service Agent or local partner if mandated by the license.

- Sole Establishment / Freelancer – A single-owner private business.

- On the Mainland, this structure is typically available only to UAE or Gulf residents in certain sectors; foreign nationals usually cannot use it (except for professional licenses via a local agent).

- Some Free Zones offer Freelancer or Professional licenses, allowing foreigners to register as individual entrepreneurs. Examples include twofour54 Media Zone or Fujairah Creative City.

- The owner is personally liable for all business debts, and the license is tied to a specific individual.

- Branch Office – For businesses already registered outside the UAE.

- A branch has no separate legal entity; it operates as an extension of the parent company.

- Must obtain a business license (Mainland via DED, Free Zone via the respective authority) and operate within the parent company’s approved activities.

- Advantages: No minimum capital requirement.

- Disadvantages: The parent company bears full liability for the branch.

- Mainland branches usually require a Local Service Agent, a UAE citizen or company representing the branch to authorities (without ownership or management control, compensated with a fixed fee).

- Representative Office – A special type of branch that does not conduct commercial activity or generate income.

- Used for marketing, research, market entry studies, and finding partners.

- Cannot sell products or services directly.

- Registration requirements are similar to a branch, but the license is limited to representative functions.

- Joint Stock Company (Public or Private JSC) – For large-scale businesses.

- Public JSC (PJSC): Required if planning to issue shares to the public or IPO. Minimum of 5 founders and a high capital requirement (at least AED 30 million for public companies).

- Private JSC: Can be formed by 2 or more shareholders, with lower capital requirements.

- Governance and financial reporting regulations are strict.

- Rarely used by foreign investors for new business ventures, typically reserved for large investment projects or subsidiaries of existing corporations.

Tip: For 90% of foreign investors, the optimal choice is an LLC (Mainland or Free Zone) or a Branch Office. These forms are relatively simple and allow full business operations. More complex structures, like joint stock companies, should be considered only for specific reasons and large-scale project.

Licenses and types of activities in the UAE

In the UAE, a business license effectively serves as a company registration certificate and defines the activities a company is allowed to conduct. A company cannot legally operate without a license. The main types of licenses in the Emirates are divided into four categories:

1. Commercial License (Trading License) – For trading activities, including wholesale and retail, import/export, and logistics.

2. Industrial License (Industrial License) – For manufacturing, industrial production, factories, and plants.

3. Service/Professional License (Service/Professional License) – For providing services such as consulting, IT, marketing, education, legal services, or any activity based on professional qualifications.

4. Tourism License (Tourism License) – For businesses in tourism and hospitality, including tour operators, travel agencies, hotels, and entertainment services.

Some sources also distinguish a General Trading License, a special subtype of the commercial license, which allows trading a wide range of products without narrow specialization.

Each license is tied to a specific list of permitted activities. The official registry contains over 2,000 economic activities, ranging from “textile trading” to “software development.” Founders must specify which activities the license will cover when submitting their application. For example, under a service license, one can choose “marketing consultancy” or “management consulting.”

It is important to select all necessary activities carefully, as operating outside the scope of the license is prohibited. Multiple related activities can often be included under a single license (sometimes free, sometimes for an additional fee depending on the zone).

Licensing Procedure:

After choosing a jurisdiction and preparing documents, the application is submitted either to the DED (for a Mainland company) or the Free Zone Authority. The application specifies the desired license type and list of activities.

- If certain activities are regulated (e.g., medical services, education, financial services), additional approval from the relevant authority is required.

- Example: a medical clinic must be approved by the Department of Health; a financial consulting firm requires approval from the Securities & Commodities Authority (SCA) or the Central Bank.

- Most standard commercial and service licenses do not require external approvals and are issued directly by the registering authority.

A UAE business license contains key information about the company:

- Registered name

- Legal form (LLC, Branch, etc.)

- List of permitted activities

- License manager (responsible person)

- Shareholders/owners

- Legal address

Validity:

- Typically 1 year (some Free Zones issue licenses for 2–3 years).

- Renewal is mandatory; late renewal may result in fines or even license cancellation.

Step-by-step guide to company registration in the UAE

Let’s go through the process of setting up a company step by step. Assume you are a foreign entrepreneur planning to establish a new business in the Emirates. The overall registration process will look like this:

Step 1. Define your activity and jurisdiction

First, clearly determine what type of business you will operate and where in the UAE you plan to operate. This decision affects your license type and registration location. As mentioned, the UAE has three main jurisdictions: Mainland (onshore), Free Zones, and Offshore.

- Mainland – Choose this with a commercial or professional license if you plan to serve clients throughout the UAE (e.g., opening a store, restaurant, construction company, or providing services to local residents and businesses).

- Free Zone – Optimal for international trade, IT development, service exports, or online projects where physical presence in the UAE market is not required. Free Zones generally offer less bureaucracy and tax benefits.

- Offshore – Suitable for holding or investment purposes without operational activity inside the country.

At this stage, check whether a special approval is required for your business type. For example:

- A travel agency requires a tourism license and approval from the Department of Tourism.

- Financial consulting may require Central Bank approval.

It is recommended to clarify these details in advance with a local lawyer or directly at the registration authority.

Once you have defined the business direction and registration location, move on to the legal setup of the company.

Step 2. Choose a company name

Create a unique name for your company. The name must comply with UAE regulations:

- Uniqueness – The name should not duplicate or closely resemble existing company names in the UAE. Authorities verify this through their database.

- Legal form – Include the company type abbreviation (LLC, FZE, FZ-LLC, etc.). Example: GlobalTech Solutions LLC.

- Permissible words – Profanity, offensive or inappropriate terms are prohibited. Religious names, government entities, and official symbols cannot be used (e.g., Dubai Police LLC is not allowed). Avoid names of ruling families or countries.

- Relevance to activity – The name should not mislead about the company’s business. For instance, a consulting license cannot use “Bank” or “University” in the name without proper licensing.

- Language and translation – The name can be in English, Arabic, or both. Foreign language names may require translation into Arabic and official attestation. Arabic names must be spelled correctly.

- Brand names – If using a trademark in the name, ensure you have the right to use it. The UAE enforces trademark protection, and registration authorities may request proof of rights if the name matches a known brand.

Prepare 3–5 name options. In the registration application, you can usually list several alternatives in case some are rejected. At this stage (or alongside the next step), submit a request to reserve the trade name with the DED or Free Zone Authority. Name reservation requires a small fee and is valid for a limited time (usually six months), during which you must complete company registration.

Step 3. Obtaining initial approval

Initial approval is the official confirmation from the registration authority that they have no objection to the formation of your company and the chosen business activity. Essentially, it is a preliminary check of your application. On the Mainland, this procedure is handled by the DED of the respective emirate, while in Free Zones it is managed by the Free Zone Authority.

To obtain initial approval, you will need to submit the following documents and information:

- Completed company registration application form – as required by the authority.

- Business plan or brief project description – not always mandatory, but many Free Zones request a summary of the business, especially for new activities or startups.

- Copies of passports of all founders (and beneficiaries if different) and the future director/general manager. All passports must be valid.

- Company name options – at least one, preferably several (see Step 2). If the name has already been reserved, include proof of reservation.

- Reference letter from a bank or financial documents – sometimes a letter confirming financial standing or a bank statement is required. Existing businesses or owners may need to provide financial statements for the past 1–2 years to assess investor credibility.

- No Objection Certificate (NOC) – in certain cases: if a founder already resides in the UAE on a work visa, a permission letter from the current employer is required to open a new business. If the founder is a company, an NOC from the home country authorities may be required.

- Copy of existing license/certificate of incorporation – if the founder is a legal entity opening a subsidiary, provide the parent company’s incorporation documents, translated into English/Arabic and notarized.

- Letter of Intent – a short letter addressed to the regulator stating your intention to open a company and briefly describing the project (sometimes used instead of a full business plan).

The initial approval confirms that your application meets the requirements: the name is acceptable, founders are not blacklisted, and the business activity is generally permitted. At this stage, final registration has not yet occurred; you are given the green light to continue preparing the full documentation.

Note: For certain business activities, the regulator may require additional approvals before issuing initial approval. For example:

- Tourism projects must obtain approval from the Department of Tourism.

- Medical businesses require approval from health authorities.

- Educational ventures need clearance from the Ministry of Education.

If your business falls under such categories, you must submit applications to the relevant regulatory body simultaneously.

Step 4. Office rental and company address

After obtaining initial approval (or sometimes concurrently), you need to arrange a legal address and office space. Every company in the UAE must have a registered address. Requirements differ between Mainland and Free Zones:

- Mainland company:

You must provide a lease agreement for an office or commercial space. Minimum office size often depends on the type of activity and the number of visas you plan to obtain. Even small businesses usually require a modest office (e.g., 20–30 sq.m., or a flexi-desk in a coworking space if allowed). The lease must be registered with the municipal system (Ejari in Dubai, Tawtheeq in Abu Dhabi). Lease term is typically at least one year, paid upfront. Without a valid lease, the license will not be issued. Budget accordingly, as prime locations can cost tens of thousands of USD per year. - Free Zone company:

Requirements are more flexible. Many Free Zones provide ready-made solutions: virtual offices, shared workspaces, fully equipped offices, or warehouses. Small businesses often only need a flexi-desk, which grants access to a shared workspace for a set number of hours per month, provided by the Free Zone itself (e.g., DMCC, Dubai Silicon Oasis). If your business requires physical space (store, warehouse, production), the Free Zone will allocate a unit that can be rented or purchased. At registration, you must select a specific space and obtain a lease or allocation letter from the Free Zone Authority. The Free Zone often acts as the landlord, issuing the agreement quickly upon request. - Offshore company:

No physical office is required, but you must have the address of a registered agent in the UAE, usually provided automatically during registration.

Once the office/address is arranged, provide a copy of the lease (or Free Zone allocation letter) to the registration authority. At this stage, you have initial approval, reserved company name, and office agreement, and are ready to proceed to final registration.

Step 5. Company registration and license issuance

The final stage involves submitting the full documentation package, paying fees, and receiving incorporation documents. Typically included:

- Memorandum of Association (MOA): Key document for an LLC outlining shareholder contributions, capital, company objectives, and management structure. Mainland LLC MOA is signed before a UAE notary; in Free Zones, signing can be done with a zone officer or remotely (some zones allow e-signatures).

- Articles of Association (AOA): Required for certain company types (especially Joint Stock Companies). For most LLCs, MOA is sufficient.

- Founders’ resolution to appoint directors: Required for branches or joint stock companies; may be included in MOA.

- Power of Attorney: If acting via a representative, notarized POA is needed.

- Copies of passports and photos of founders/directors (may be requested again in higher quality).

- Payment receipts for registration fees: company registration, license, incorporation certificates, shareholder cards, etc. Fees vary by emirate/zone and activity type. Free Zone licenses start around 5,000 AED (~$1,360); Mainland Dubai licenses ~10–15k AED, excluding other costs.

Once verified and paid, the registrar issues:

- Certificate of Incorporation: Confirms company formation and registration number.

- Trade License: Authorizes the company to operate, listing approved activities (issued physically and electronically).

- MOA with official seal (notarized copy).

- Share Certificates (if applicable).

- Certificate of Incumbency / Good Standing (some Free Zones) confirming company and key personnel status.

- Establishment Card / Company ID (for Mainland), required for immigration and visa procedures.

Congratulations! Your company is now officially registered. You may begin operating under the issued license, though practical steps such as opening a bank account, hiring staff, and obtaining residence visas remain.

Step 6. Opening a bank account in the UAE

Commercial activity in the UAE cannot proceed without a corporate bank account, so it is recommended to start this process immediately after company registration. The UAE has many local and international banks, and a corporate account can be opened with any of them. Note that opening a company account is significantly more complex than opening a personal account for a foreign individual.

For a personal bank account (if, for example, you are a resident individual):

- Passport

- Valid UAE residence visa

- Emirates ID

In some cases, banks may also request a salary letter from your employer or a company account statement to verify income. The process for personal accounts is generally quick.

For a corporate bank account, a new business must provide a more extensive set of documents:

- Company incorporation documents: Certificate of Incorporation, Trade License, MOA, Establishment Card.

- Passports, visas, and Emirates IDs of all shareholders and directors.

- Proof of address of shareholders (e.g., utility bill with registered address, translated into English for non-residents).

- Bank statements for the past 6–12 months for each shareholder and director, translated into English, to show fund flow and financial history.

- Business plan or detailed description of the company: source of funds, planned clients, and transaction volumes.

- Information on counterparties: a list of potential key clients and suppliers, their countries, and approximate transaction amounts.

- Company website: having a website with business information increases credibility. The bank may review it.

- Sample contracts or invoices (if preliminary agreements exist) to verify business activity.

- Reference letters (optional but helpful) from foreign banks or business partners confirming reliability.

- Additional documents as required: resumes of owners, proof of experience in the field, licenses from other countries, etc.

The bank’s compliance process can take several weeks to a couple of months. Banks conduct thorough checks and may request additional information. Recently, some UAE banks are cautious with clients from CIS countries due to sanction risks; however, Dubai and Abu Dhabi remain neutral jurisdictions and continue to open accounts if the business is fully transparent.

Tips:

- Prepare all requested documents carefully.

- If one bank refuses your application, try another, as requirements may vary.

- Alternatives include opening accounts with fintech platforms or payment service providers that accept UAE companies. While faster, having a full-fledged bank account is recommended for reliability and convenience.

Visa matters and relocation to the UAE

After registering a company, foreign founders and employees become eligible to apply for UAE residence visas. Having a residence visa allows you to legally live in the country, rent property long-term, access local benefits (such as preferential school fees, opening bank accounts, etc.), and most importantly, eventually obtain a UAE tax residency certificate.

How to get a visa through your company: In the UAE, each company has a visa quota – a limited number of residence visas it can sponsor. The number of visas depends on the office size: usually 1 visa per ~10 m² of office space (exact rules vary). Even small companies with a flexi-desk usually have 2–3 visas available (for the owner and 1–2 employees).

The visa process:

- The company obtains an Establishment Card from the immigration authorities.

- The company applies for an Entry Permit on behalf of the employee or owner.

- The individual enters the UAE or changes status if already in the country.

- Medical examination and biometric Emirates ID enrollment are completed.

- The residence visa is stamped in the passport (usually valid 2–3 years depending on emirate and visa type) and a physical Emirates ID card is issued.

- Founders typically receive an Investor Visa (Partner Visa).

- Employees receive Employee Visas sponsored by the company.

- If the company is dissolved or an employee leaves, the visa is cancelled.

Tax residency vs. residence visa: To be considered a UAE tax resident, you must:

- Hold a residence visa

- Physically stay in the UAE at least 183 days per year

- Apply for a Certificate of Tax Residency from the UAE Ministry of Finance

Merely holding a visa without spending sufficient time in the UAE does not grant tax residency; you remain a tax resident of your home country.

Long-term visas: Since 2019, the UAE offers Golden Visas for 5 or 10 years to outstanding specialists, investors, and entrepreneurs. Examples:

- Investment in real estate ≥ 2M AED (~$545K) → 5-year investor visa

- Investment ≥ 10M AED (~$2.7M) in companies/funds → 10-year investor visa

- Successful startup founders may be eligible for long-term visas

- Green Visa for entrepreneurs and investors, valid 5 years if criteria are met

For most businesses, a standard business visa valid 2–3 years (renewable) is the common choice.

Family sponsorship: Holders of company-sponsored residence visas can sponsor visas for spouses, children, and parents, subject to income requirements. This is important for entrepreneurs considering UAE not only as a business hub but also as a place of residence.

Costs of opening a company in the UAE

The cost depends on jurisdiction, license type, company size, number of visas, use of agents, and more. Key expenses include:

- Registration fees and license

- Free Zone packages: ~$5–8K (basic, 1 license, 2 visas); advanced: $10–15K

- Mainland Dubai/Abu Dhabi: ~$8–10K+

- Offshore: ~$1.5–3K (no trade license required)

- Office rent

- Flexi-desk in a Free Zone: ~$2–3K/year

- Full office (50 m²) in Dubai: ~$20–30K/year

- Mainland offices: one-year upfront payment required

- Visa and immigration fees

- One visa: ~$1,000 (varies by emirate)

- Optional agent fees: ~$800–1,500 per visa

- Deposit for employees: refundable ~$800–1,500

- Share capital

- Minimal capital usually required; some zones mandate deposits (e.g., DMCC 50,000 AED)

- Free Zones like twofour54 require none

- Agent/consultant services

- Full-service consulting firms: $3,000+ depending on services

- Other costs

- Document notarization, translation, legalization ($50–100 each)

- Company seal (~$50)

- Accounting software or accountant

- Mandatory medical insurance for residents

Estimated budget:

- Minimum for a small startup: $5–7K

- Average realistic budget for full business setup: $10–15K

- Annual ongoing expenses (license renewal, rent, accounting): ~$10–20K/year

Careful budget planning is essential to ensure expenses are covered and revenue can sustain the business.

Promising business sectors in the UAE

The UAE market is dynamically developing, offering foreign investors opportunities across many industries. Some sectors are particularly promising in the coming years:

- Trade and Distribution

The UAE has historically been a regional trade hub. Import-export operations, wholesale of consumer goods, auto parts, electronics, food products, etc., remain in high demand. Many companies use Dubai as a re-export platform. Trade is one of the most common business directions. - Logistics and Warehousing

Closely linked to trade, there is demand for warehousing, 3PL logistics, and fulfillment services for e-commerce. The advanced infrastructure of ports (e.g., Jebel Ali – the largest Middle East port) and airports makes the UAE ideal for logistics bases. - Construction and Real Estate

Large-scale construction projects are constantly underway – skyscrapers, residential complexes, and infrastructure. With a large expat population, housing demand is steady. Investment opportunities exist in real estate, development, construction contracting, real estate brokerage, and property management. - Tourism and Hospitality

Dubai, Abu Dhabi, and coastal resorts are popular tourist destinations. Opportunities exist in hotels, restaurants, entertainment, and travel agencies. UAE investments in new tourism projects (eco-tourism, cultural attractions) create niches for entrepreneurs. - Information Technology and Telecom

The UAE aims to become a hub for tech startups, with a focus on fintech, AI, and blockchain. Zones such as Dubai Internet City, Dubai Silicon Oasis, and Abu Dhabi Hub71 offer incentives for IT companies. Opportunities include software development, service platforms, game studios, cybersecurity, and other high-tech fields. - Crypto Industry and Finance

The UAE is one of the first countries to regulate cryptocurrencies and blockchain projects. Dubai has VARA (Virtual Assets Regulatory Authority) and a Crypto Centre in DMCC. Many blockchain startups and crypto exchanges establish offices here. The financial sector, including forex, investment funds, and asset management, operates in DIFC and ADGM, financial free zones with common-law frameworks attractive to international organizations. - Consulting and Business Services

As new companies enter the UAE, demand grows for accounting, legal, marketing, and other B2B services. Consulting in business setup, transaction support, HR services, etc., is competitive, but niche expertise from international markets can give an advantage. - Manufacturing and Industry

The UAE is expanding its non-oil industrial sector. Industrial zones (e.g., KIZAD in Abu Dhabi, Dubai Industrial City) support production in food, pharmaceuticals, construction materials, and chemicals. Incentives include reduced electricity tariffs, access to port infrastructure, and export subsidies.

Other emerging sectors include renewable energy, agri-tech (vertical farming), e-commerce, education, and online learning. Market research is recommended before launching, which can be provided by consulting firms, including our company specializing in UAE market analysis.

Conclusion

Opening a company in the UAE is a responsible but achievable step for foreign entrepreneurs. The Emirates offer a unique combination of tax benefits, a business-friendly regulatory environment, and extensive opportunities. Key points to remember:

- Choose the right structure and location: Consider jurisdiction (Mainland or Free Zone) and company type according to your target market, scale, and benefits. Proper setup helps avoid future re-registration or restrictions.

- Thorough document preparation: Ensure all documents comply with naming, licensing, and office requirements. Well-prepared paperwork speeds up registration. Use checklists provided by Free Zones or the Department of Economic Development (DED).

- Transparency is key: Especially financially. Banks and authorities will request business plans, proof of funds, and transaction verification.

- Financial planning: Budget not only for the startup phase but also for the first 1–2 years, including license renewals, office rent, and other operational costs. Maintain reserve capital for flexibility.

- Local expertise: UAE laws have unique features. Professional consulting firms or local specialists can help avoid mistakes, advise on taxes and reporting, and liaise with authorities, saving time and money.

- Conducting a market analysis is equally important before entering the UAE market. It helps you understand demand, identify competitors, and choose the right positioning strategy.

If you need a comprehensive market analysis or business strategy, you can contact Indeso Consulting — our team provides in-depth research, market insights, and actionable recommendations to ensure your business launch in the UAE is successful and sustainable.

The UAE business environment favors innovation. Foreign investors are actively welcomed, and companies gain access to a growing market, international financial hubs, and a stable jurisdiction for capital protection. With careful planning and compliance, a UAE business can support international expansion and generate significant returns.

Sources:

- UAE Government – Starting a business in a Free Zone: Key steps.

- UAE Ministry of Economy – Free Zone company setup guide.

- PwC – Doing Business in the UAE (2023).

- RIA Mo – Interview with K. Tantsyura, SKY Consulting (2023).

- Immigrant Invest – Guide to UAE business and investor visas.