Marketing and selling cosmetics in the USA: laws and trends

by indesoCosmetics and Personal Care Market in the USA: Laws, Trends, and Opportunities for Foreign Brands

The cosmetics and personal care market in the United States is one of the largest and fastest-growing in the world. As of 2024, the market size is estimated at approximately $100–102 billion, with an expected annual growth rate of 5–6% over the next decade.

Drivers of growth include:

-

Rising average incomes;

-

High interest in new products and innovations;

-

Rapid development of e-commerce;

-

Increased focus on sustainability and product quality.

For foreign brands, the U.S. offers significant opportunities due to its diverse consumer base—ethnic, cultural, and age-wise. Consumers seek both premium brands and products tailored to their skin type, personal care traditions, and cultural preferences. High-potential segments include skincare, makeup, sun care, hair care, and anti-aging products.

Regulation of Cosmetics: FDA and MoCRA

At the federal level, cosmetics are regulated by the U.S. Food and Drug Administration (FDA). Key regulatory areas include:

-

Product labeling: Ingredients, allergens, and usage instructions must be clearly listed.

-

Ingredient safety: Toxic or harmful substances are prohibited; manufacturers must conduct safety assessments.

-

Good Manufacturing Practices (GMP): Production must occur in a controlled environment to ensure quality and safety.

Since December 2022, the Modernization of Cosmetics Regulation Act (MoCRA) has introduced additional requirements:

-

Mandatory registration of manufacturing facilities;

-

Product notification and reporting of adverse events;

-

Safety verification before products enter the market.

Important: Regularly check updates from the FDA regarding ingredients, labeling, and allergens.

Product Classification: Cosmetics vs. Drugs

Correct product classification is critical. If a cosmetic is marketed with therapeutic or protective claims, it may be classified as an over-the-counter (OTC) drug. For example, sunscreen or SPF antiperspirants may fall under drug regulations depending on claims. Misclassification can result in fines, product recalls, and regulatory enforcement by the FDA.

State-Level Variations

State laws can be stricter than federal regulations:

-

California: strict limits on potentially carcinogenic chemicals.

-

New York: bans mercury and other hazardous substances.

-

Florida and other states: specific labeling, packaging, and safety requirements.

When planning sales, compliance with state regulations where products are shipped is essential.

Mandatory Registration and “Responsible Person”

Under MoCRA, product registration is mandatory. Notifications must be submitted within the set timeframe (e.g., 120 days after market launch).

The Responsible Person—manufacturer, packer, or distributor listed on the label—is accountable for:

-

Product safety;

-

Registration and notification;

-

Allergen labeling;

-

Product recalls if necessary.

Business registration, including for foreign entities, is mandatory and must be renewed every two years.

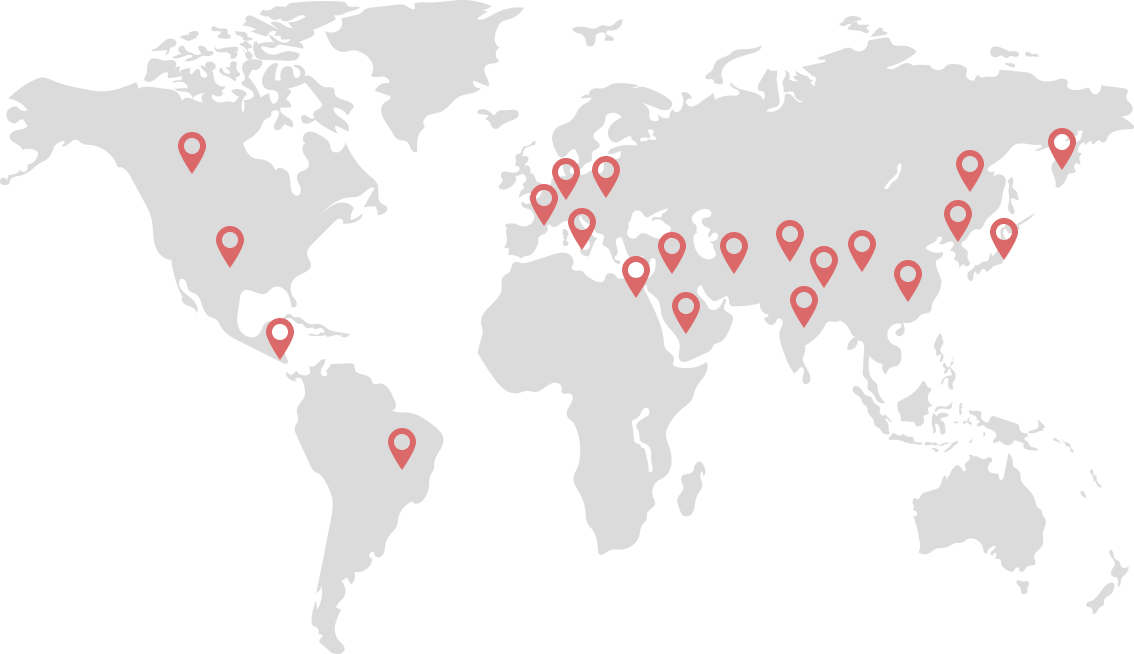

Demographics and Target Consumers

The U.S. cosmetics market is characterized by diverse ethnic and age groups. Brands must consider these differences when developing products and marketing strategies.

Licensing and Legal Requirements

Selling cosmetics in the USA requires compliance with federal and local regulations:

-

General business license;

-

Seller’s permit for tax purposes;

-

Cosmetic manufacturer license (if producing in-house).

Selling without proper licensing can result in fines, legal liability, and loss of customer trust.

Trends in the U.S. Cosmetics Market

Successful brands must consider current market trends:

-

Clean beauty and natural ingredients: paraben- and sulfate-free, safe components.

-

Personalization and customization: products tailored to skin type, age, and individual preferences.

-

Sustainability: reusable packaging, recycling, and carbon footprint reduction.

-

Multifunctional cosmetics: 2-in-1 or 3-in-1 products, including BB and CC creams with SPF.

-

Influencer marketing and social media: Instagram, TikTok, YouTube; influencer recommendations impact purchasing, especially among Gen Z.

-

Inclusive beauty: products for diverse skin and hair types, emphasis on diversity.

-

Wellness and self-care: cosmetics as part of overall health and well-being.

-

K-Beauty: multi-step skincare, essences, serums, 2-in-1 products, natural ingredients, visual marketing.

-

Technology and innovation: digital diagnostic tools, AR try-on for products.

Competition and Opportunities for Foreign Brands

The U.S. market is highly competitive, with a focus on quality and innovation. Established players include L’Oréal, Estée Lauder, Revlon, and numerous niche and independent brands. Any new entrant must offer a unique product that stands out and attracts consumer attention.

Opportunities for foreign brands:

-

Offer unique ingredients and formulas not available from existing brands.

-

Consider ethnic and cultural preferences, adapting products to skin types, colors, and traditions.

-

Use online sales and social media marketing to quickly reach target audiences and build customer loyalty.

High-potential growth segments:

-

Skincare and facial products

-

K-Beauty and multi-step Korean routines

-

Organic and clean beauty

-

Hair care

-

Anti-aging and restorative products

Tips for Success in the U.S. Market

To succeed in the U.S. cosmetics market, foreign brands should:

-

Comply with federal and state regulations (MoCRA, FDA).

-

Offer high-quality, safe, and trend-relevant products.

-

Maintain a user-friendly website optimized for mobile.

-

Provide detailed product information to build trust.

-

Ensure secure payments and financial protection.

-

Be active on social media, engage audiences, and run promotions.

-

Encourage customer reviews to strengthen reputation.

-

Implement a strong marketing strategy: SEO, PPC, influencer marketing, loyalty programs, and excellent customer service.

-

Offer discounts and promotions to drive repeat purchases.

-

Focus on customer-centric service and fast post-sales support.

-

Adapt to trends like clean beauty, K-Beauty, multifunctional products, inclusive and eco-friendly cosmetics, and wellness-oriented lines.

-

Optimize shipping and returns through professional 3PL services and clear return policies.

Conclusion

Entering the U.S. cosmetics market is a huge opportunity and a significant challenge. Success requires offering a unique product, maintaining high quality, and deeply understanding consumer needs. Brands that combine innovation, quality, regulatory compliance, and attention to diverse consumer groups can gain a competitive edge in one of the world’s largest and most dynamic markets.

A strategic, comprehensive approach—covering market research, competitor analysis, legal compliance, and trend adaptation—is essential to build a sustainable, profitable, and trusted brand in the U.S.

Popular

Related articles

Markets we study