How to enter the Polish market: a guide for entrepreneurs

by indeso

Poland is not just a neighboring country with a rich culture and history — it is also one of the fastest-growing markets in Europe. With EU membership, a strategic location, and a stable economy, Poland has become an attractive entry point for companies looking to operate not only in Central Europe but across the European Union.

Why Poland?

Entering the Polish market provides access to 500 million EU consumers without tariff barriers. Labor and rental costs are lower than in Western Europe, while the level of skilled professionals remains high. Additionally, Poland offers a relatively favorable tax system: the standard corporate tax rate is 19%, and a reduced rate of 9% applies to small businesses.

Step 1 — Market Analysis

Before registering a company, it is crucial to understand whether your business idea is in demand in Poland. Key actions include:

-

Competitor analysis: Identify who already offers similar products or services, their pricing, and marketing strategies.

-

Consumer habits: Polish consumers value good quality-to-price ratios and build trust gradually. Reputation and localization — including language and cultural nuances — are critical.

-

Regional differences: Markets in Warsaw and Kraków differ significantly from Gdańsk or Rzeszów. Larger cities have higher competition and rent but more paying customers.

-

Trends: E-commerce, eco-friendly products, IT services, and outsourcing are rapidly growing in Poland.

This analysis helps tailor your strategy to local realities rather than simply copying a business model from another country.

Step 2 — Choosing a Legal Form

Foreign entrepreneurs in Poland can choose from several legal forms, but the most common is Spółka z ograniczoną odpowiedzialnością (Sp. z o.o.), equivalent to a limited liability company.

Why Sp. z o.o. is popular:

-

Minimum share capital is just 5,000 PLN.

-

Founders and directors can be non-residents.

-

Alternatives include opening a branch or representative office — faster and cheaper but with limited authority.

Step 3 — Registration Process

-

Prepare documents: Articles of association, founder details, registered address (can be virtual), and an electronic signature for online registration.

-

Register with the National Court Register (KRS): Submit documents in person or via the online S24 system. This usually takes a few days to a couple of weeks.

-

Obtain identification numbers:

-

REGON: statistical number.

-

NIP: tax identification number.

-

VAT registration if applicable (standard rate 23%).

-

Step 4 — Post-Registration Obligations

-

Submit owner details to the Central Register of Beneficial Owners (CRBO) within 14 days.

-

If share capital was paid, PCC tax (0.5%) may apply.

-

Submit NIP-8 form to the tax office within 21 days.

-

For international trade, obtain an EORI number.

-

Accounting in Poland is strictly regulated; reports may be required annually or monthly.

Step 5 — Bank Accounts and Employees

-

Opening a bank account may require personal presence.

-

To hire employees, register with ZUS (Social Insurance Institution) for social contributions.

Polish Market Considerations

-

Language: Knowledge of Polish is crucial for marketing and sales. English is not universally preferred.

-

Brand trust: Polish consumers rely heavily on recommendations and reviews. Building local reputation is key.

-

Price sensitivity: Shoppers compare prices carefully and respond well to promotions and loyalty programs.

-

Trade fairs and industry events: Excellent channels for B2B companies to enter the market.

Tips to Save Time and Effort

-

Use the correct PKD codes — Poland’s official classification of business activities, which affects taxes and requirements.

-

Work with local lawyers or consulting agencies: Polish bureaucracy can be complex, especially for non-residents.

-

Budget for mandatory ZUS contributions, even if the company is temporarily inactive.

Conclusion

Entering the Polish market is more than just registering a company. It involves analyzing demand, adapting your product to local preferences, preparing documentation, and complying with legal requirements. Proper planning and understanding of local business practices are essential for success.

Popular

Related articles

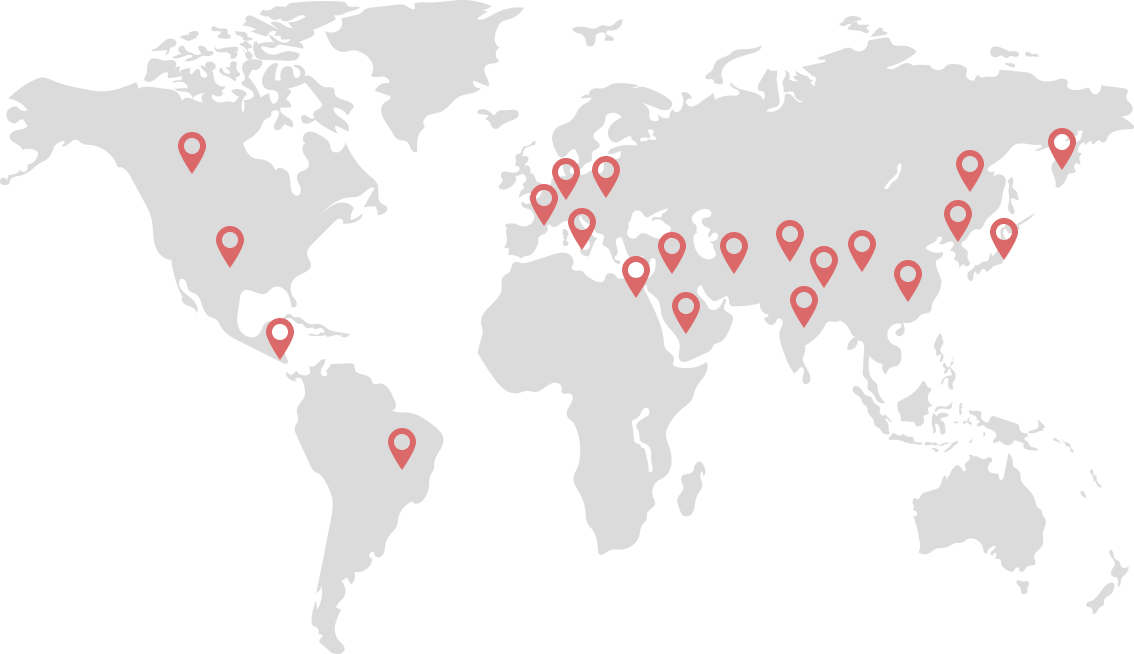

Markets we study