Entering the Spanish market: research, strategy, and growth opportunities

We’ll conduct a precise market analysis of Spain — identifying trends, audience needs, and growth opportunities for your business

We’ll create an effective business plan — turning insights into a strategy that helps you enter the market confidently

Our services

We thoroughly analyze the Spanish market and create a comprehensive business plan to help your company quickly and confidently seize new opportunities

We thoroughly analyze the Spanish market and create a comprehensive business plan to help your company quickly and confidently seize new opportunities

With Indeso, you’ll discover the Spanish market, understand your customers, and launch a business that truly attracts and grows

For a successful business launch in Spain, it’s essential to understand not only the numbers but also the people — their culture, communication style, and behavior. Indeso helps you enter the market with confidence by providing up-to-date data, analytics, and clear, insight-based recommendations.

We study your target audience, assess the competitive landscape, and identify key trends so you can build a strategy that truly works in Spain. Our experts develop a clear, goal-oriented action plan — from brand positioning to marketing communications.

20+

years

helping companies expand into new markets

100+

businesses

successfully expanded into Asia, Europe, and American markets with our support

10+

experts

work with us, each having completed a rigorous 5-step selection process

10 000+

dollars

saved on average when expanding into new markets

Entering the Spanish market is not just a step — it’s an opportunity for growth and expansion. Indeso helps you navigate this path with confidence: we analyze the market, competitors, and audience behavior so you can build a strategy that leads to measurable results.

Indeso’s team of consultants, with over 20 years of experience in international consulting, helps companies successfully launch and grow their businesses in Spain — from understanding their target audience to minimizing startup risks.

- • We are practitioners, not theorists. Many of us have created and developed our own businesses, so we know how to achieve growth even in new markets.

- • We possess international expertise. Experience working in Europe, Asia, and America allows us to adapt strategies to different cultures and business models.

- • We have world-class education. All consultants hold master’s degrees in strategy, management, or international business from leading global schools.

- • We deliver real results. Companies we work with increase their profits by an average of 30% or more within the first year.

- • We have experience with industry leaders. Our specialists have carried out consulting and strategic projects for Tetra Pak, Ernst & Young, Sberbank, HSBC, and other international companies.

- • We have a global mindset. We speak multiple languages fluently and know how to build effective communication in multicultural environments.

Benefits of doing business in Spain

Spain market research methods

Competitors analysis in Spain

Result

Application

Result

We analyze the Spanish market, identify unique opportunities for your business, and create a strategy that helps you enter the market confidently, stand out from competitors, and achieve sustainable growth.

Application

Selection of optimal pricing and product assortment

Development of effective positioning

Identification of new opportunities for product expansion

Risk reduction when entering the market through understanding the competitive landscape

Consumer survey in Spain

Result

Application

Result

We uncover what drives your customers in Spain — their motivations, expectations, and perception of your brand. Based on these insights, you can create marketing campaigns and communications that hit the mark.

Application

Create effective marketing campaigns

Adapt products and services to meet customer expectations

Build sales forecasts based on reliable data

Public information сollection and analysis

Result

Application

Result

We provide you with fresh insights into the Spanish market — key indicators, trends, and industry shifts. This data helps you see the big picture and make decisions that move your business forward.

Application

Identify growth opportunities and new business directions

Develop a market entry strategy based on current trends

Reduce risks using verified information

In-depth interviews with experts in Spain

Result

Application

Result

Real opinions and insights from industry experts — the kind of knowledge you can’t get from raw data. We conduct interviews that provide you with practical insights and a competitive edge.

Application

Gain a deeper understanding of the market specifics and its risks

Develop a market entry and business scaling strategy

Assess prospects and identify hidden opportunities

Social listening

Result

Application

Result

Understand what customers in Spain think about your brand and products. We analyze online reactions and trends so you can respond to changes in time, strengthen your positive image, and prevent reputation risks.

Application

Adapt marketing campaigns to current trends and customer expectations

Respond to negative feedback and improve audience engagement

Find additional ways to connect with customers

Focus group setup and analysis

Result

Application

Result

You hear directly from your customers — understanding what drives them, what they expect, and what stops them from choosing your product. This feedback helps you create offers that truly resonate with your audience.

Application

Adapt your product and communications to customer needs

Develop marketing strategies that increase trust and conversion

Test hypotheses and identify new opportunities for promotion

Why analyze the Spanish market

-

Study Spain’s legal and regulatory requirements that must be considered when entering the market to ensure proper and secure business registration.

-

Understand the behavior and preferences of Spanish consumers to adapt your product, communications, and services to their expectations.

-

Analyze key competitors in the Spanish market, their strategies, and strengths to build effective positioning and secure your niche.

-

Identify current and future trends in the Spanish market, minimize risks, and make informed strategic decisions.

To effectively grow a business in Spain, it’s essential to study the market in order to:

-

Adapt your business model and marketing strategy to Spain’s cultural and economic specifics for maximum effectiveness.

-

Discover new niches and growth opportunities that remain hidden without in-depth market analysis.

-

Develop a step-by-step market entry plan for Spain to avoid financial mistakes and ensure a sustainable launch.

-

Determine the optimal pricing strategy, considering Spanish consumers’ income levels, purchasing habits, and the competitive landscape.

Risks and challenges of doing business in Spain

Without prior analysis, a business risks facing unforeseen barriers — from tax and labor issues to operational challenges. In-depth market research in Spain helps identify these risks in advance, adapt your strategy, and ensure a sustainable launch.

Plan to enter the Spanish market?

Schedule a free consultation

During the consultation, you will receive valuable insights for your business:

Schedule a consultation-

Quick analysis to assess your company’s readiness to enter a new market

-

Checklist: “How to Save Over $10,000 When Entering the Spanish Market”

-

Demonstration of a market study so you can clearly see the depth and detail of our work

-

Recommendations on structure: branch or subsidiary

-

Answers to your specific questions

-

Quick analysis to assess your company’s readiness to enter a new market

-

Checklist: “How to Save Over $10,000 When Entering the Spanish Market”

-

Demonstration of a market study so you can clearly see the depth and detail of our work

-

Recommendations on structure: branch or subsidiary

-

Answers to your specific questions

Results our clients get

Who will benefit from a Belgian market analysis

Companies looking to enter the Belgian market

-

Assess demand, understand the competition and regulatory requirements, develop an effective strategy, and minimize financial risks by adapting your business to local conditions and customer needs.

Entrepreneurs looking to start business in Belgium

-

Understand the needs of your potential audience in your niche, learn about legal requirements, and receive information on ways to legally reside in the country through business.

Start-up founders and experts

-

Learn how to organize and successfully launch your own business, choose the right niche and positioning strategy, and identify the needs of your customers — all under the guidance of an experienced expert.

Testimonials

Contacts

Frequently asked questions

What are the key benefits of starting a business in Spain?

Reduced corporate tax rates for new companies.

Access to EU and North African markets.

Government grants and incentives for R&D and employee training.

Simple company registration process with low minimum capital requirements.

What taxes and social contributions should I expect in Spain?

Corporate tax: Standard 25%, with reduced rates for new companies.

Social security contributions for employees: up to 24%.

VAT: 21% standard rate (with exemptions in certain cases).

Double taxation treaties: Spain has agreements with 88 countries.

How can I understand Spanish consumers?

Studying the market and conducting research on consumer behavior, preferences, and expectations is crucial. Only around 30% of the population speaks English, so localized strategies are key to effective communication.

What are the main risks of entering Spain without market research?

Choosing unprofitable niches due to moderate domestic demand.

Overlooking regional differences (Catalonia, Madrid, Andalusia, Valencia).

Misjudging cultural expectations and consumer behavior.

Facing bureaucratic or operational challenges without proper preparation.

Can you help with legal and regulatory requirements in Spain?

Yes, we analyze Spain’s legal framework and regulatory requirements, ensuring your company is correctly registered and fully compliant with local laws.

How does Indeso conduct market research in Spain?

We combine qualitative and quantitative methods, including:

Competitor and industry analysis

Consumer surveys and focus groups

Expert interviews and field research

Analysis of regulatory and economic data

This ensures reliable, data-driven insights for your business decisions.

How do I start a business in Spain?

Contact Indeso to receive tailored research, a clear market entry strategy, and step-by-step guidance to launch and grow your business efficiently.

What should I know about the business culture in Spain?

Spanish business culture values personal relationships, trust, and face-to-face communication. Meetings often start with small talk to build rapport, and decision-making can take longer as consensus is important. Punctuality is appreciated, but flexibility is common, and understanding regional differences (e.g., Catalonia vs. Andalusia) can improve business interactions.

What should businesses know about doing business in Spain?

Doing business in Spain requires understanding local regulations, business culture, and consumer preferences. Building strong relationships, respecting formalities, and adapting products or services to local needs are key to success. Expert support can help navigate legal requirements, identify opportunities, and establish reliable partnerships.

Why is branding important for entering the Spanish market?

Branding for the Spanish market helps companies adapt their message to local cultural nuances, consumer behavior, and language specifics. A well-localized brand builds trust, strengthens market positioning, and increases recognition among Spanish customers and partners.

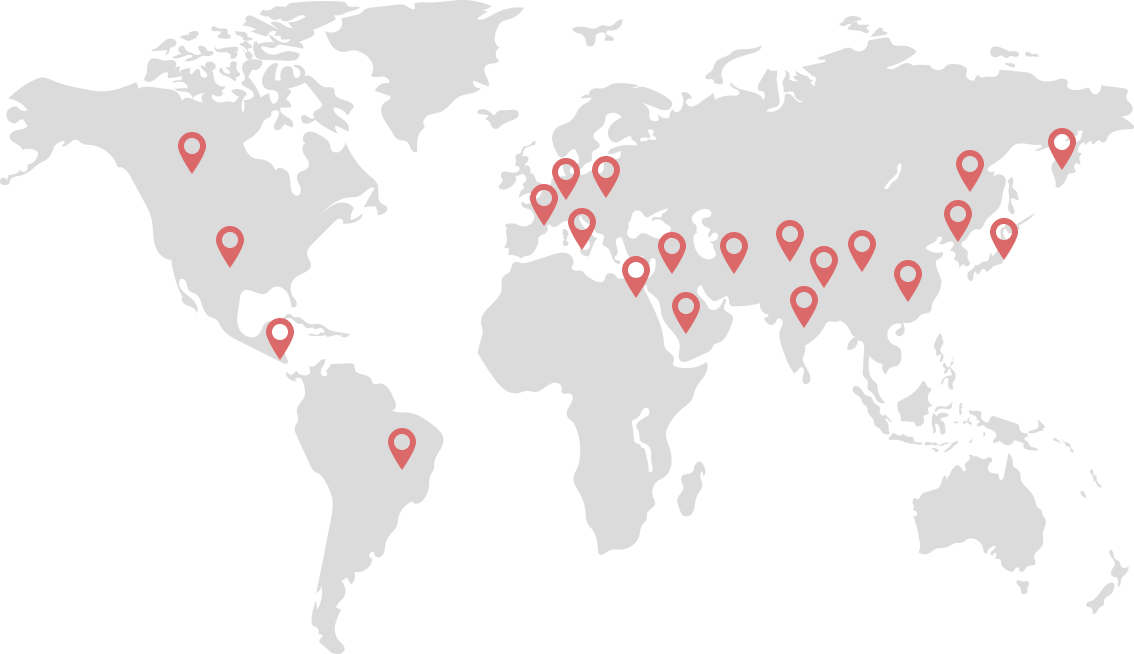

Markets we study